Maltese aircraft leasing

The Maltese VAT authorities have issued guidelines in respect of leasing arrangements following expert technical studies which identified a method of calculation based on the aircraft’s range. These guidelines simplify the VAT treatment of leasing arrangements for qualifying parties.

The Maltese Authorities apply the option provided for in article 59a of the VAT Directive whereby the tax is not applied on the part of the lease which is enjoyed outside the European Union.

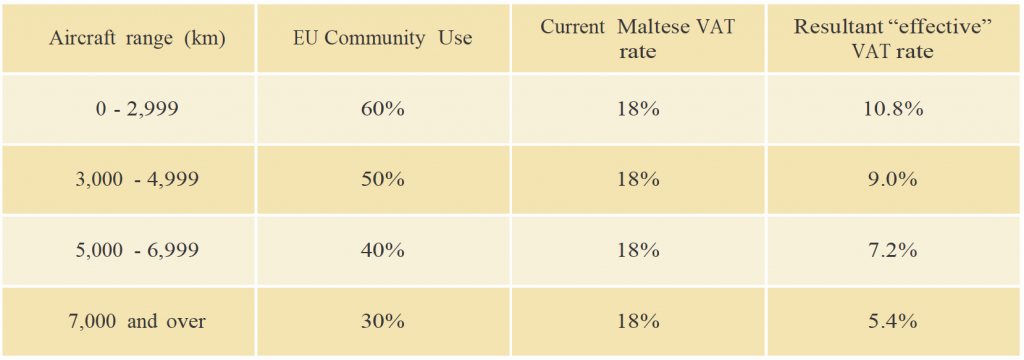

The table published enables the calculation of VAT payable whilst the aircraft is deemed to be used in the European Union airspace during the currency of the lease and the resultant “effective” rate. In order for the treatment above to apply, the following conditions must be satisfied:

- The lessor must be a company or person established in Malta and registered for VAT

- The lessee must also be established in Malta and be unable to reclaim input tax in respect of the lease

- The lease arranged must be, as defined, a long-term lease or hire of the aircraft which may not exceed 60 months. The lease instalments shall be payable monthly from the outset of the lease

- Each lease proposal requires prior approval from the Maltese Commissioner for Revenue; who may impose conditions as deemed appropriate and may vary the guidelines at any time

- Upon the conclusion of the lease, an option to purchase the aircraft may be offered by the lessor. The purchase price must represent a profit to the Lessor and VAT at the full prevailing rate shall be payable on the price agreed

- Should the Lessee exercise an option to purchase the aircraft, the Maltese VAT department will issue a certificate evidencing the VAT paid status of the aircraft.